Struggling to combine those paper receipts?

Frantically searching your Inbox for invoices and pay reminders?

Spending dinners data-entering for your BAS?

These are signs you’re feeling that EOFY crunch. And this year, the Australian Taxation Office (ATO) is cracking down on small businesses, since it put a hold on chasing outstanding payments throughout the pandemic. This means most Aussie businesses are rushing to ensure their books are in order.

The honest truth is, there’s not much you can do about it now. But you can do something soon to help avoid this rush in the future, and make your tax time as easy as possible.

Below are three ways to get your business EOFY ready for the next financial year.

1. Go Digital

The simplest and most effective thing you can do — as earliest as possible — is get those invoices and receipts digitised.

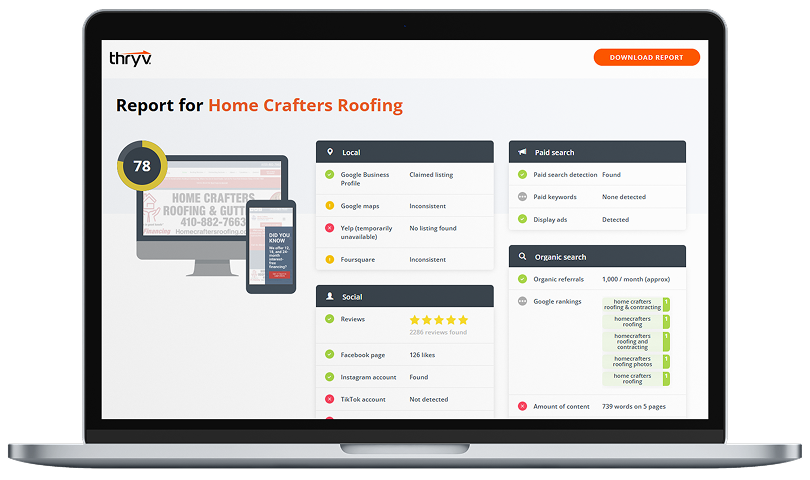

The easiest way is to get a CRM (that’s customer relationship management software). Having automated software can help align customer purchases to invoices and payment receipts.

Keeping these digital has another great effect: It means you can avoid having to data-entry and calculate everything yourself. A CRM tracks digital payments and keeps them counted for your convenience.

Want to quickly see how often a particular service or product was purchased? You can track these digitally as well. Not only are you saving yourself time at EOFY, but you’re also making micro-business analyses to help you see what is working, and what’s not.

Lastly, your payments provider should be able to link to your CRM to ensure card processes and transactions are also tracked. Not having a linked payments provider means your digitisation efforts will be wasted. You’ll need to spend time aligning payments and transactions with your receipts, wasting valuable time anyway.

2. Take Advantage of Temporary Full Expensing

This is unique to Australian businesses, and a great way to help your business get that “Go Digital” goal under its belt.

Temporary Full Expensing gives you a tax deduction for the costs of any capital assets. That means you can spend money implementing things like CRMs, payment processors, integrated point-of-sale systems, accounting software and more.

While you may not have the cashflow or the time right now to get ahead of Temporary Full Expensing, the program runs until 30 June 2023. This is perfect to help you get ahead of your EOFY claims next year.

This will make buying that all-important CRM — like Thryv! — a lot easier, knowing you’ll receive a full tax benefit from doing so. Plus, you’ll get all the other benefits of having an all-in-one software.

3. Stop Chasing Bad Debt

Tax time forces you to also worry about your non-payments.

Known as “bad debt”, these are unpaid invoices and outstanding payments. Fortunately, the ATO allows you to claim a deduction to your tax if you write these off.

The only clause is it must be included as assessable income in the current, or a previous, income year.

This means most businesses scramble during EOFY to find any outstanding payers or invoices. This will sometimes double the amount of work they have to go through at tax time.

While writing off the debt is fine for tax purposes, getting paid is better. Again, a digital solution helps to easily see which payments are still outstanding (Thryv lets you see this at a glance), and to chase those payments in the first place.

An automated system can follow up payments post-sale. No more calling and leaving voicemails that are never heard. An automated follow-up system can use multiple ways of communication, like text messaging and emailing, to chase that payment for you.

If you’re using the Thryv solution for this, you can chase more than payments. The system automatically sends review requests when payments are made. That helps you secure the next sale even as you conclude the one at hand.

Bonus Tip: Review Your Business Plan

More than ever before, the Australian economy is going through a state of volatility. What worked for small businesses last EOFY may not this time (especially with the ATO’s pursuing of tax debts).

Perhaps it’s time to review your business plan in tandem with a professional, such as an accountant. This can help you assess whether your existing strategies are working, and help you identify changes and opportunities that can improve your bottom line for the upcoming year.

But most importantly, along with digitisation and automation, this can help you ensure you’re spending your time wisely— something that’s ever-more important as tax time crunch hits.