When you think about the first impression you give potential customers, what comes to mind? You probably have a certain standard you hold yourself and your staff to. You may have a specific way you talk to new leads, uniforms or a dress code you adhere to, introductory offers you consistently deliver, and more. All of these things contribute to the perceived level of service you’ll offer potential new customers.

One of the biggest, and often overlooked, things that affects your first impression is how you share estimates, quotes and invoices. Big brands have this down to a science. They have templates and fancy software that help them share electronic payment communications quickly and professionally. And in doing so, the message they send is, “We’re professional. We’re easy to work with. We are safe to work with. And we’re reliable.”

If your business wants to be all those things, an electronic payment processing and communications tool could be the answer.

What to Look for in Electronic Payment Processing and Communications

Did you know 84% of small businesses still rely on manual processes? That means sending hand-written estimates, taking payment by cash, check or manual credit card processing, and more.

How do you handle sending estimates, quotes and invoices to potential clients?

There are plenty of online, electronic invoicing services out there. But most of them don’t help you seal the deal with customers at the beginning of their journey and then wow them throughout. Here’s what to look for in your electronic estimates and invoicing service or payment processing tool.

On-the-Spot Estimates and Quotes

If you’re like most, you have to step away at the end of initial consultations to calculate your estimated costs of labor, materials, and more. Then, you either return to deliver your hand-written estimate in person or deliver the same estimate over the phone or in a voicemail.

What happens in the minutes and hours before you were able to get your estimate into your prospect’s hands? I’ve got a guess. Their excitement about you (and your great services) likely decreased, and they started worrying about how much everything would cost. They came up with new objections and questions. Then, you walked back into a completely different situation when you returned with that estimate.

What if you could deliver an estimate in the exact moment you have a prospect amped about what you could do for them? You’d close deals at a much higher rate. So choose an electronic estimates and invoicing tool that allows you to trigger these communications from a mobile device, on the spot.

Editable Templates

That on-the-spot electronic estimate is only effective if it really fits you and your business. No quote, estimate or invoice you send should include caveats about the information within. It should allow you to customize things like:

- Quantities, including decimal intervals, of a certain product or service

- Custom policies and terms depending on the client or service

- Naming conventions that fit your business (e.g. “quote” versus “estimate”)

- Which type of taxes you include, and the ability to include more than one

You should be able to build payment communications templates that fit your business, and they should be editable both before you send and after the fact.

Coupons to Seal the Deal

You probably win a lot of business by creating urgency with things like early booking incentives or introductory offers and coupons. Quotes and estimates look a lot more enticing when they include these special offers!

Make sure whatever tool you choose includes callouts like these that entice prospects to act right then and there.

Customizable Calls to Action

Speaking of enticing prospects to act, have you ever missed a phone call from a prospect trying to let you know they want to book your service? The phone tag that followed likely frustrated you and the prospect, and in some cases it may have even lost you their business.

Make phone tag a thing of the past by introducing calls to action within your electronic communications. Think about what you want prospects and customers to do when they receive things like quotes, estimates and invoices. Things like:

- Accept this Quote

- Book Now

- Pay Now

The right tool will let you incorporate these calls to action by way of clickable buttons so you’re easy to do business with whether your client is behind a computer or on their smartphone.

Integration with Your Payment Processor

In the end, if you’ve delivered a service, your goal is to get paid. So most importantly, the service provider you use to send payments communications like electronic estimates and invoices should plug directly into your payment processor. If it doesn’t, you’ll miss out on tracking opportunities, automated receipt triggers, and more.

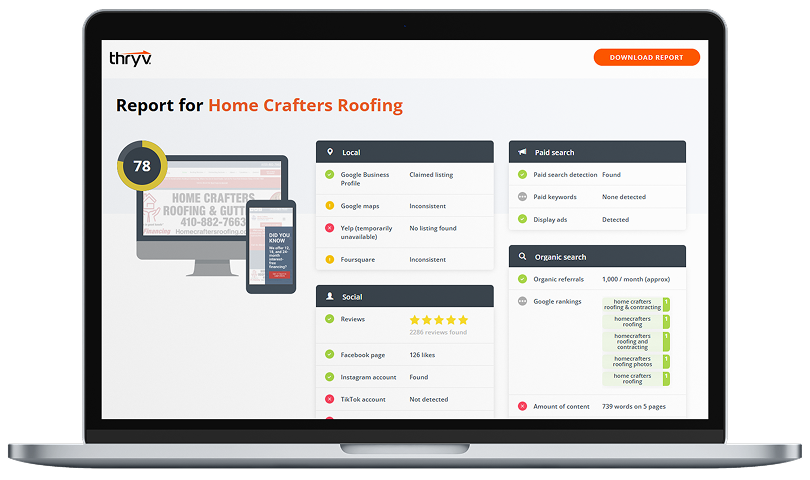

You’ve probably guessed our tool Thryv can do these things. You’re right. Explore Thryv’s payment and communications functionality today.