By Katherine Jones, Coterie Insurance

Every small business contends with risk. Though you likely do what you can to prevent and mitigate your business’s exposure to risk, no plan is entirely foolproof.

Without adequate small business insurance coverage, your business may be held liable for a claim made against it. Despite all your best-laid plans, a single claim made against your business may find you on the hook for millions of dollars.

Small Business Insurance shifts liability from your business to your policy. In turn, you’re protected from covered claims and aren’t responsible for forking over more money than your business can afford.

Business liability coverage is typically provided through General Liability Insurance and Professional Liability Insurance. Both policies protect your business from certain risks that could otherwise spell disaster for the continued success of your company.

Why Do Small Businesses Need General Liability Insurance?

General Liability Insurance is the most basic liability coverage a business can purchase, but that doesn’t mean it’s not useful or necessary.

In many ways, General Liability coverage seems like insurance for “blue-collar” businesses because it protects against claims of physical damage, such as property damage and bodily injury. However, its protection against reputational harm — libel, slander and harm via advertising — makes it necessary coverage for many “white-collar” businesses as well.

Property Damage

Let’s face it: No matter how careful you are, there’s always a chance Lady Luck took the day off and you end up damaging a customer’s property.

Unfortunately, the cost of repairing or replacing damaged property may skyrocket beyond what you can afford — and that’s not including potential legal fees.

Consider the damage a contractor could cause by ruining a countertop with glue. Perhaps some glue dripped onto the counter as the contractor worked above it. Or maybe the contractor absentmindedly put the tube down, spilling some glue in the process.

Whatever the reason, the homeowner may hold the contractor responsible for making things right. The contractor may end up on the hook for the cost of replacing the counter. He may even find himself in court, racking up attorney fees and court costs, as well as the cost of a settlement or judgment.

Unless the contractor was covered by sufficient General Liability Insurance. A GL policy would pay out for any covered claims. It would also pay the cost of the contractor’s legal defense and any resulting judgment.

In turn, the contractor’s business would be spared the cost of replacing the countertop and any legal fees.

Bodily Injury

Professionals don’t head to work intending to harm someone. However, it’s an unfortunate occurrence that may quickly lead to costly medical expenses and litigation. A broken leg alone may cost upwards of $7,500, in addition to hospital costs and a potential lawsuit.

Accidents happen, even if you’re the paragon of OSHA standards.

For example, consider what could happen if a customer slipped on a floor the housekeeper had just cleaned. A simple fall may lead to medical complications beyond a cut and bruises, especially if the customer sustained a traumatic brain injury. This is a condition that may require lifetime treatment of $85,000 to $3 million.

Fortunately, the housekeeper would be protected by his or her General Liability Insurance. GL coverage would cover the customer’s medical expenses (up to the coverage limits of the policy). It would also defend the housekeeper in court.

For some claims, General Liability Insurance may pay for an injured party’s medical payments without assigning blame. This “good-faith” coverage is designed to pay out immediately after a claim has been filed to cover the customer’s injuries and, hopefully, dissuade the customer from filing suit.

Reputational Harm

Have you ever gone online to rant and rave about a competitor? Twitter fingers may get you into deep trouble if you’re accused of libel, slander, or “advertising injuries.”

Reputational harm may not always be caused intentionally, either. An off-the-cuff remark or thoughtless comment may just as quickly land you in legal hot water as a vitriol-fueled Facebook comment disparaging your competition.

For example, the owner and teacher of ABC Yoga Studio may find herself frustrated when XYZ Yoga Studio opens in town. Her regular students, curious about the new studio, begin to miss classes in favor of the newcomer.

Annoyed, the owner of ABC takes to social media, insinuating that the teachers at XYZ lack credentials and shouldn’t be teaching. The post draws attention and negatively impacts the new studio’s income.

Understandably, the owner of XYZ Yoga Studio files suit, alleging defamation and seeking damages. ABC Yoga Studio’s General Liability coverage would pay for the studio’s legal defense. It would also pay for any potential settlement or judgment. And with any luck, the owner of ABC would learn to refrain from angry social media posts in the future.

Why Do Small Businesses Need Professional Liability Insurance?

Professional Liability Insurance covers claims arising from your profession (hence the name). In some industries, Professional Liability coverage is also referred to as Errors and Omissions Insurance or Medical Malpractice coverage, leading many to assume it’s a more “white-collar” type of insurance product.

However, as General Liability Insurance is useful for more than just customer-facing businesses. Professional Liability coverage is similarly important for both blue- and white-collar businesses.

Negligence and Malpractice

When a customer hires you to perform a service, they’re putting faith in your skills and qualifications. They expect that you’ll exercise reasonable care.

For example, it’s a reasonable assumption for a hairdresser to use safe products and to refrain from using a product deemed unsafe for a given customer.

A hairdresser who chooses to use a product unsafe for a customer’s hair may be considered negligent if the product causes an undesired effect, such as lost hair or unwanted coloring.

Similarly, misusing a product may result in an allegation of negligence. If a hairdresser failed to follow a product’s directions and left it in a customer’s hair for too long, causing a chemical burn, the salon may find itself the recipient of a lawsuit.

Professional Liability Insurance would cover the cost of the salon’s legal defense, as well as any judgment or settlement.

Professional Liability coverage would even extend to false claims of negligence. Consider a customer who fails to follow a salon’s recommendations after treatment. As a result, the customer’s hair falls out and they file suit against the salon.

Though the salon isn’t responsible for the customer’s hair loss, it must still defend against the litigation, incurring costly legal fees in the process.

Errors and Omissions

Humans make mistakes. Unfortunately, even honest mistakes can cost small businesses small fortunes in damages and legal fees. Such mistakes may even have more than a monetary cost. They can lead to a loss of life — including that of a pet.

Veterinarians are often as big an animal lover as the pet parents who visit them. Yet a vet may still make a mistake. During a routine exam, a vet may fail to spot signs of cancer in a dog. Weeks later, the cancer may become much more visible, having metastasized to the point where it’s inoperable and incurable.

The dog’s furious and grieving owner holds the vet accountable for not spotting any tumors in the recent exam, at a time when the dog had a better chance of treatment and survival. As a result, the owner files suit against the vet.

In such a case, the vet’s Malpractice Insurance, a form of Professional Liability coverage, would defend the vet from litigation and cover the cost of court fees and damages.

Misrepresentation

Professionals and small businesses are often depended on for their expert advice. As specialists in their fields, professionals are expected to have the right answers about certain areas of their industry.

Sometimes, though, a poorly worded phrase may constitute bad advice. This can unintentionally cause harm to the person seeking your expertise.

For example, a massage therapist operating out of a salon may have all the intentions in the world of doing right by his clients. However, during a massage, he offers advice that, later on, causes his client to injure herself.

The client files a claim against the massage therapist, alleging his advice led to her injury. Fortunately, the therapist’s Professional Liability coverage would protect him from accumulating hefty legal fees and having to pay for any damages, if any.

Incomplete or Inaccurate Work

Clients and customers rely on small businesses to get the job done by an agreed-upon deadline. Failure to live up to that deadline can have significant downsides for the customer, including lost income and contracts.

For example, a construction company may promise to build a house to completion by a given date. The new homeowners excitedly prepare to move in, selling their current home and preparing to move from out-of-state.

However, as the deadline approaches, their new home is nowhere near complete and their current home has already been sold. The homeowners are forced to put their belongings in storage and rent a room at an extended stay hotel until their new home is ready.

To recoup their losses, the homeowners file suit against the construction company, which would be protected from liability by its Professional Liability coverage.

Why Do Small Businesses Need Workers’ Compensation Insurance?

Workers’ Compensation Insurance is a compensation bargain that pays for your employees’ medical costs, funeral expenses, retraining and rehabilitation. It also covers a portion of their lost income after a work-related incident.

Though you take on some form of liability by paying the premium of a Workers’ Comp policy, the policy itself covers an employee’s expenses following a covered incident. In exchange for this guaranteed compensation on behalf of your employees, they give up the right to sue you for damages.

The result is a win-win for both parties. Your business is protected from claims that could cripple it or lead to bankruptcy. At the same time, your employees receive compensation for injuries and illnesses sustained at work without the long, arduous hassle of a lawsuit.

How to Protect Against Other Business Liabilities

It’s a wise (and sometimes mandatory) choice for small businesses to carry some degree of General Liability and Professional Liability coverage. Whether you operate a blue-collar or white-collar business, both insurance policies protect against a wealth of potential risks.

Some businesses or industries are exposed to a greater breadth of hazards. Fortunately, policy additions, called endorsements, enhance your insurance policy. Therefore, this bridges any gaps that remain and may be added to your coverage as your business evolves and grows.

How to Purchase Small Business Liability Insurance

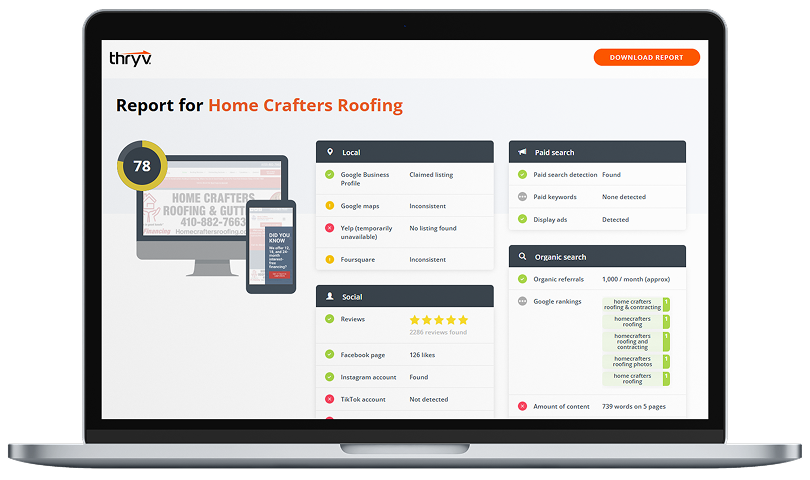

Through Thryv’s partnership with Coterie, you can quickly and easily request a quote for Small Business Liability Insurance that meets your needs. Provide some basic information about your business and industry, then get your quote. You’ll be able to purchase coverage that brings you some well-deserved peace-of-mind and protection from liability.