In light of the COVID-19 pandemic, corporations around the country are doing what they can to support struggling small businesses and families. Some are waiving late fees for customers, others extended usage limits on their software, and many are offering discounts on their products and services.

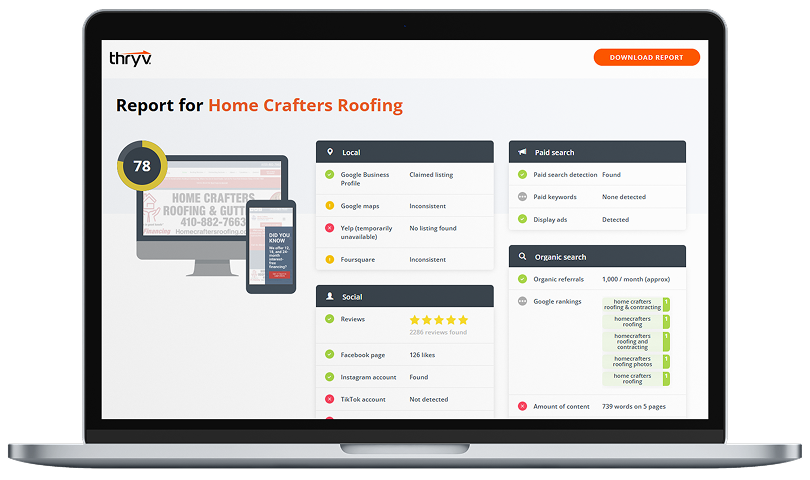

Free: Online Presence Scan See how your business compares to the competition and find out what customers are saying about you.![]()

Unfortunately, for many small businesses being forced to shut down during the pandemic, discounts and free stuff can’t keep them afloat.

The Thryv Small Business Foundation Impact

Acting fast, the Thryv Small Business Foundation announced it will soon wire funds to the first recipients of its Small Business COVID-19 Grant Program, a grant application program that awards immediate grants to struggling small businesses.*

Individual recipients of the cash grants will receive between $2,500 and $15,000 via wire transfer.

While there are other grant and loan programs available, foundation leadership says they’re able to finance these grants immediately — a massive advantage for businesses that have already been hit hard by the pandemic’s economic impacts.

Recognizing Recipients

Many individuals and groups have contributed and donated to the grants’ funding. With more than 2,000 submissions within a week, the foundation is proud to offer as much assistance as possible.

Foundation leaders say they will continue fundraising to support struggling small businesses.

Meet some of the earliest grant recipients, below.**

Beckman & Associates, Inc.

Beckman & Associates in Florida offers services to children who demonstrate a need for speech, occupational and physical therapy. According to the pediatric therapy clinic, the pandemic not only caused them to have to cancel their pathologist conference, it also forced them to shut their doors. Parents are fearful of leaving their homes for therapy that requires direct contact. Unfortunately, teletherapy is not appropriate for the majority of their patients.

Beckman & Associates says the grant should help the clinic be open for the families that need them after the COVID-19 pandemic passes.

Burningtree Country Club

Burningtree Country Club is a family friendly country club in Decatur, Alabama. Since the official federal and state declarations of business closures, the country club has lost a significant amount of revenue from previously scheduled events. While they still offer food to go, their restaurant operation has taken a massive hit as well. The country club says many of their team members are furloughed, and they worry they’ve lost the sense of community they worked so hard to build prior to the pandemic.

Burningtree Country Club says the grant should allow them to bring back some of the part-time staff that count on their wages for their livelihood and to reinvest in public and community outreach.

Dogtopia of Highland Village

Dogtopia in Texas provides dog daycare, boarding and spa services. According to Dogtopia staff, they were just beginning to thrive as a small business. Unfortunately, cancellations started coming in for Spring Break boarding and daycare beginning in February. Soon after, they were mandated to close as a non-essential business.

Dogtopia says the grant should help them pay essential bills like rent and utilities so they can reopen as soon as allowed.

Heart ‘n Home

Heart ‘n Home is a floral business in rural Iowa. According to them, March, April and May are typically the busiest months of the year for florists — due to prom, Easter, Graduation, Mother’s Day, weddings and Memorial Day. By the time the COVID-19 pandemic hit and they were forced to close their storefront, they had already invested a significant amount of money on prior orders for these special occasions. Despite offering no-contact delivery, demand is significantly down.

Heart ‘n Home says the grant should help them pay essential bills like rent, utilities and insurance so they can reopen. In the meantime, they’re giving away flowers that would otherwise go unused.

JRINK Juicery

JRINK Juicery is proud to be one of the few healthy juice and smoothie options in Washington D.C. and the greater Virginia area. With the pandemic forcing them to close all storefronts, JRINK has lost upwards of 80% of their revenue. They’ve also had to temporarily lay off a majority of their staff.

JRINK Juicery says the grant should serve as startup funds to fuel their growing grocery and juice delivery business. As it gets warmer, they’ll need to invest in coolers, ice packs and vehicle maintenance to stay in business.

Roman K Salon, LLC

Roman K Salon is a trendy, premium salon business located in New York City, a known hub of the COVID-19 pandemic’s spread in the U.S. The salon’s owners made the difficult decision to halt their operations before state mandated closures to protect the health and safety of their staff and clients.

Roman K Salon says the grant should help them pay rent and other critical bills, and support their family during the shutdown.

The Local Distro

The Local Distro is a neighborhood market, restaurant and dog park — all in one — in Nashville, Tennessee. The Local Distro says they began struggling prior to the pandemic, when they were impacted by the deadly Tennessee tornado that hit in early March of 2020. Since then, the COVID-19 outbreak forced them to close entirely. Both disasters mean they only accrued 7 days of revenue in March.

The Local Distro says the grant should help them repair damage to the flooded storage and supply room at the business. It will also likely go toward payroll, mortgage and utility payments while they remain closed.

Thistle Pig Restaurant

Thistle Pig is a small, owner operated, farm-to-table restaurant in South Berwick, Maine. Proud to support local farmers and to provide high-quality food and ingredients to customers, the pandemic has devastated their operations.

Thistle Pig says the grant should help them keep business running through the pandemic so they can prepare to reopen as soon as able.

Want to help?

Due to the overwhelming demand, grant applications are now closed. But plenty of small businesses still need help.

Click here to donate and help more struggling small businesses. All donations are tax-deductible to the extent allowed by law.

Find additional COVID-19 crisis resources for small businesses here.