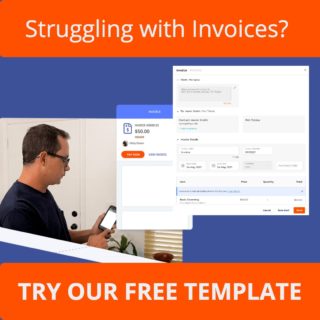

An invoice seems like yet another piece of paper or electronic document for your customers to look at once and never again. But, perhaps you feel that way because you only see it once. We promise it’s not a waste of time.

Invoicing serves several purposes beyond the obvious: getting paid.

What Is an Invoice?

An invoice is a document that itemizes transactions between a business and its customers. It cites purchase specifics as well as transaction date, payment method and any discounts.

An invoice is different from purchase orders and estimates because it tracks an actual sale instead of just listing the service price.

Your business invoice should include:

- The word “invoice” clearly stated

- Your company name

- Business contact information

- Customer’s name

- Billing time and date

- A unique reference number

- Product or service description

- Total owed

- Due date

- Payment terms, including early payment details, financing charges or late payment fee

- Return or refund policies

We’ve come a long way from manually documenting sales in carbon copy receipt books, and even printed receipts. With the help of electronic invoices, invoicing is now cheaper, easier and faster.

The trick is to make sure your end-to-end customer relationship management (CRM) system makes it easy to send interactive estimates, invoices and overdue payment reminders.

Secret Marketing

If your CRM has collected years of invoices, you have an untapped competitive advantage: the ability to predict trends. Invoicing eliminates the quarterly guess-and-check game of determining each season’s hottest sellers. The information is at your fingertips.

Using that insider knowledge and the empty real estate at the bottom of your invoice, you can cross-sell your customers on other services.

Or maybe you’d rather use that space to share major business changes on the horizon. No matter what you wish to share, you can transform your invoices into marketing opportunities.

Related Reading: HOW TEXT MESSAGE INVOICING GETS YOUR SMALL BUSINESS PAID FASTER

Payment Tracking

Making sure you’re collecting the right data to keep up with your accounting can make your head spin, even if Quickbooks® is integrated into your CRM.

An invoice will help you and customers keep track of what payments were made as well as what’s owed. (Your business can bypass this added stress altogether by setting up automated installment plans with ThryvPay.)

An invoice will help you and customers keep track of what payments were made as well as what’s owed. (Your business can bypass this added stress altogether by setting up automated installment plans with ThryvPay.)

When it comes to staying on top of your cash flow, invoices are key to ensuring the money coming in takes care of everything going out.

Legal Protection

Your customers are at the heart of your business. And while you can’t imagine them ever trying to ruin your business, it’s better to be safe than sorry.

Between 36% and 56% of small businesses are involved in some form of litigation every year.

Because invoices detail the services you provided, they help protect you during a lawsuit. An invoice coupled with a contract provides physical proof the client agreed to pay you for the services provided.

According to BestSmallBusinessLoans.com, the combination of the two creates a legally binding situation for everyone involved.

Easy Tax Filing

Tax season is easily the least exciting season for small business owners. The saying goes, if you stay ready, you don’t have to get ready. Well, invoices help you stay ready for when tax deadlines circle back around.

Those invoices are documented proof the tax information you submit is accurate. The IRS recommends keeping daily transaction records for this reason.

But no one expects you to keep up with 101 million sheets of paper. Online documentation is an easy, hassle-free way to prepare for a potential audit — although we wish that on no one.

Having an invoicing system keeps everyone on the right track. So skip using informal and one-off receipts and start documenting your invoicing properly — you can’t afford not to.